Simplify Your Payroll with Professional Aid-- Contact CFO Account & Services for Payroll Services

Simplify Your Payroll with Professional Aid-- Contact CFO Account & Services for Payroll Services

Blog Article

Browsing the Complexities of Pay-roll Solution: A Complete Overview for Business Owners

As business owners endeavor into the realm of handling their services, the ins and outs of payroll services usually provide a labyrinth of difficulties to navigate. From figuring out pay-roll tax obligations to making sure compliance with wage regulations, the journey can be overwhelming without an extensive guide.

Recognizing Payroll Taxes

Employers should accurately compute and keep the proper quantity of taxes from staff members' incomes based on aspects such as income degree, submitting status, and any kind of allocations claimed on Kind W-4. Furthermore, companies are responsible for matching and paying the suitable portion of Social Safety and security and Medicare tax obligations for each staff member.

Comprehending payroll tax obligations involves remaining up-to-date with tax obligation laws and laws, which can be subject and complex to alter. Failing to conform with payroll tax needs can lead to pricey charges and penalties for companies. Therefore, services should guarantee they have the knowledge and procedures in position to handle pay-roll taxes precisely and successfully.

Picking the Right Pay-roll System

Browsing payroll services for entrepreneurs, especially in understanding and managing payroll tax obligations, emphasizes the critical importance of selecting the ideal pay-roll system for efficient economic procedures. Picking the ideal pay-roll system is crucial for businesses to streamline their payroll procedures, make certain compliance with tax obligation regulations, and maintain accurate financial documents. Business owners have numerous alternatives when it involves picking a pay-roll system, varying from hand-operated approaches to innovative software program remedies.

When selecting a payroll system, entrepreneurs must think about elements such as the size of their business, the intricacy of their pay-roll needs, spending plan restraints, and the degree of automation desired. Small businesses with straightforward pay-roll demands may choose standard pay-roll software application or outsourced payroll solutions to manage their payroll tasks successfully. On the other hand, larger enterprises with more elaborate payroll frameworks might profit from sophisticated payroll systems that use functions like computerized tax obligation computations, direct down payment capabilities, and assimilation with audit systems.

Eventually, the key is to pick a pay-roll system that lines up with the company's specific requirements, enhances functional efficiency, and makes certain prompt and accurate pay-roll processing. By choosing the right pay-roll system, business owners can successfully handle their payroll responsibilities and concentrate on expanding their companies.

Conformity With Wage Legislations

Ensuring conformity with wage regulations is an essential facet of maintaining lawful integrity and honest criteria in business operations. Wage regulations are designed to protect employees' legal rights and make certain fair payment for their job. As a business owner, it is important to remain educated about the certain wage regulations that apply to your company to prevent possible legal issues click here now and punitive damages.

Trick considerations for compliance with wage laws include sticking to base pay requirements, precisely classifying workers as either non-exempt or excluded from overtime pay, and ensuring timely payment of salaries. It is likewise necessary to remain up to date with any changes in wage laws at the federal, state, and regional degrees that might affect your organization.

To properly browse the intricacies of wage laws, consider executing payroll software application that can assist guarantee and automate computations accuracy in wage repayments. In addition, looking for advice from lawful specialists or human resources professionals can give valuable understandings and assistance in preserving conformity with wage laws. Contact CFO Account & Services for payroll services. By focusing on conformity with wage regulations, entrepreneurs can produce a structure of trust and fairness within their organizations

Improving Pay-roll Procedures

Effectiveness in taking care of payroll procedures is vital for entrepreneurs looking for to enhance their business procedures and guarantee accurate and prompt payment for staff members. Enhancing payroll procedures involves applying techniques to streamline and automate jobs, ultimately saving time and reducing the danger of errors. One reliable way to simplify payroll is by buying payroll software program that can streamline all payroll-related information, automate calculations, and create reports effortlessly. By leveraging technology, business owners can eliminate hand-operated data entrance, enhance data precision, and guarantee conformity with tax guidelines.

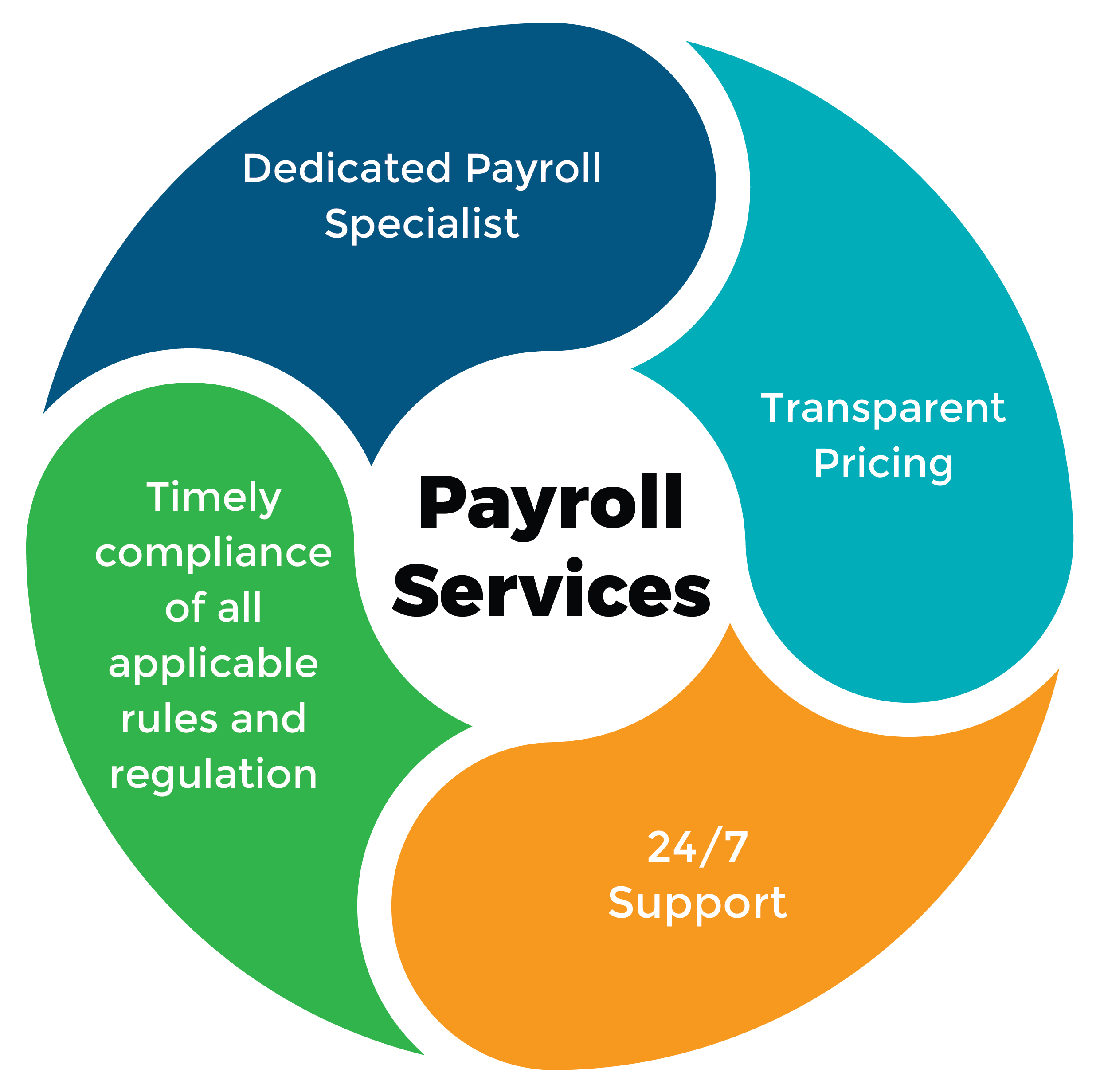

Furthermore, outsourcing pay-roll services to a dependable service provider can further simplify the process by offloading jobs to professionals who specialize in pay-roll administration, allowing business owners to focus on core organization tasks. By improving pay-roll processes, business owners can boost effectiveness, precision, and conformity in managing staff member payment. Contact CFO Account & Services for payroll services.

Outsourcing Payroll Solutions

Thinking about the intricacy and lengthy nature of pay-roll management, many business owners decide to contract out payroll solutions to specialized carriers. Outsourcing payroll solutions can offer various benefits to businesses, including cost financial savings, boosted precision, conformity with tax obligation guidelines, and liberating important time for business owners to concentrate on core business activities. By partnering with a reputable payroll provider, entrepreneurs can make sure that their employees are explanation paid precisely and promptly, tax obligations are determined and filed properly, and pay-roll information is firmly taken care of.

Verdict

To conclude, navigating the complexities of pay-roll service needs a thorough understanding of payroll taxes, picking the appropriate system, sticking to wage legislations, maximizing processes, and potentially outsourcing solutions. Business owners should carefully manage payroll to make sure conformity and effectiveness in their business operations. By adhering to these standards, business owners can efficiently manage their payroll obligations and concentrate on growing their business.

Report this page